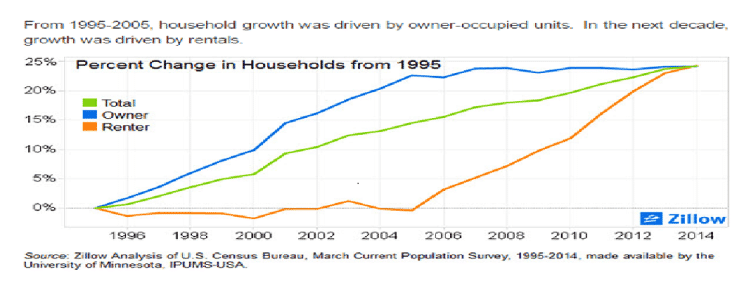

Primarily due to the mortgage, and foreclosure crisis of 2008, a very large percentage of American households has been driven by renters, especial to mention would be of single-family residences (SFRs) renters.

The second half of the twentieth century is being characterized by suburban society where Owning the stereotypical modest home with a white picket fence was long a hallmark. But because of the Great Recession, foreclosure crisis was triggered and made renters out of millions to be former homeowners.

In many areas, buying a home today is difficult for many because of the tight credit and low for-sale inventory. And to add, even as demand for the luxuries offered by a single-family residence – more space, (even a sense of) more security, a yard and access to good, suburban schools – remains robust.

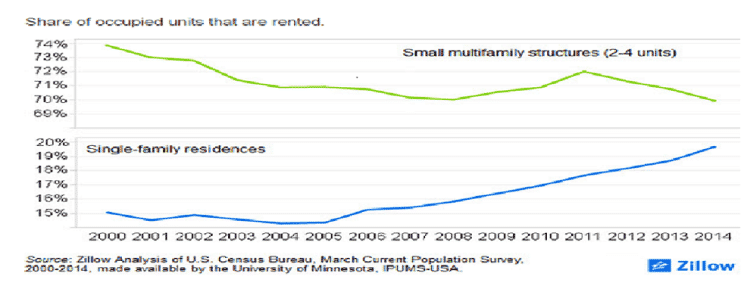

Due to these facts, SFR rentals today have become an increasingly visible and viable option for millions of families nationwide.

The convergence of three trends explains much of the growing popularity of SFR rentals:

The Foreclosure Crisis.

according to Wikipedia: ” The 2010 United States foreclosure crisis, sometimes referred to as Foreclosure-gate or Foreclosuregate, is an ongoing and unresolved issue in the United States and refers to an apparently widespread epidemic of improper foreclosures initiated by large banks and other lenders. The foreclosure crisis was extensively covered by news outlets beginning in October 2010, and several large banks, including Bank of America, JP Morgan, Wells Fargo, and Citigroup temporarily responded by halting their foreclosure proceedings in some or all states. The foreclosure crisis has caused significant investor fear in the U.S.[5] A 2014 study published in the American Journal of Public Healthlinks the foreclosure crisis with an increase in suicide rates.

One out of every 248 households in the United States received a foreclosure notice in September 2012, according to RealtyTrac.”

Because of such, early during the Housing Bust, foreclosures forced many former owners to become renters, often in the same homes or neighborhoods where they previously resided. This contributed to the growing number of renter households early in the recession.

Investor Activity.

Investors bought many of the bargain homes, coming from the rising number of foreclosure resales because of price drop, with the intent of renting them. It gives more expanded options available to the growing population of renter households, but also constrained the supply of entry-level properties in the for-sale market.

Inventory Crisis.

There are challenges and struggles facing potential new home buyers because of the competitive market characterized by low for-sale inventories, large numbers of all-cash offers, and rapidly increasing prices which made buying a home less affordable and drove potential buyers to the single-family rental market.

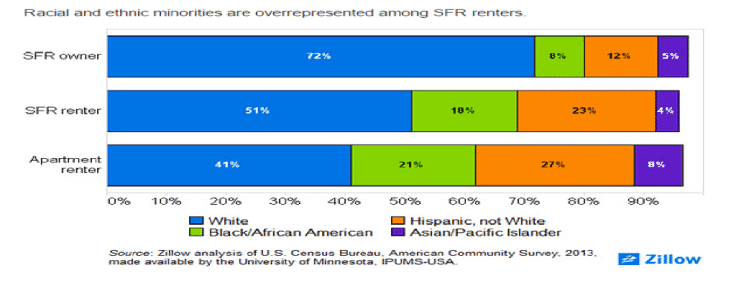

Below is the Chart which illustrates some of the trends in the Market for SFR renters, and compare compare the residents of SFR rentals with those of owner-occupied SFRs and tenants in more typical apartments. Compared to SFR owners, SFR renters tend to be younger, less-affluent families.

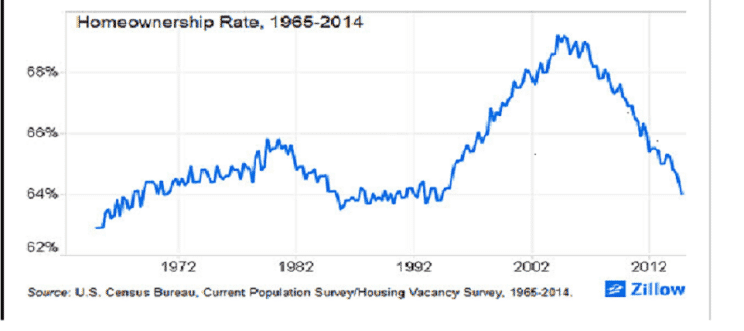

The homeownership rate increased sharply during the Housing Boom, but has declined steadily, reversing the prior decade’s gains by late 2014.